- Call or Text: (562) 690-9770

- Toll Free: (888) 541-9444

- Fax: (562) 690-9771

Why Do My California Car Insurance Rates Keep Going Up?

Do you ever wonder why your California car insurance rates keep going up, even though you have a clean driving record?

When your California car insurance rates go up have you ever asked yourself a variation of the following questions:

“My car is another year older, why does my car insurance continue to go up?”

“I don’t have any tickets or accidents, shouldn’t my car insurance get cheaper every year?”

“My car is depreciating more and more, shouldn’t my car insurance rate also go down with it?”

If you’ve ever asked yourself these questions, you’re not alone. These are questions we face and answer every day with new and existing clients. It only makes sense that as you and your car get older, that your car insurance rates should go down. However, what you’re undoubtedly experiencing is the opposite, and your California car insurance premiums are rising! why?

Before we get into the reasons, let’s consider how insurance companies determine rates for everyone. All companies subscribe to the statistical axiom of the “Law of Large Numbers”. Which says the larger the number of exposure units independently exposed to loss (you and me and our cars), the greater the probability that actual loss experience will equal expected loss experience.

Simply put, more people and cars on the road, the higher probability that they (insurance companies) will have to pay out for more claims.

In California, several major auto insurers also have requested or been approved for rate hikes this year, with most averaging roughly 7 percent.

The actions of large groups of people affect everyone else. While you may be an excellent driver, that doesn’t mean the majority of people in your zip code are. There are risks that the insurance company sees that make it statistically more likely to have something happen over time, than to have nothing happen ever. As a direct result to you, and others, insurance companies will raise California car insurance rates across the board.

So why are California car insurance rates going up with every insurance company?

Reason #1

Distracted Driving

Within the first eight months of 2016, there were an estimated 27,875 motor vehicle fatalities nationwide. That is an 8% increase from 2015 over the same span of time. Source

California as a state saw a 5% increase throughout the entire year. Traffic-fatality figures released at the end of 2015 show that 35,092 people were killed on public roads in 2015, an average of 672 every week, which is beyond the capacity of the jumbo jet in its highest-passenger configuration.

Cell-phone use behind the wheel would seem like an obvious reason why we are seeing so many more fatal accidents—Try this as an experiment, the next time you are driving, try not to look at your cell phone and just examine the actions and behaviors of those on the road with you. It shouldn’t take long to catch someone driving past you while they are looking down at their phone.

While using your cell phone while driving still remains against the law, it’s so common and accepted now as normal behavior, that until you’re directly affected by distracted driving, you’re more than likely never going to change your habit.

Due to the cost that is paid out in bodily injury claims, and fatal accident claims, companies have little to no choice but to raise California car insurance rates.

The best way to end distracted driving is to educate all Americans about the danger it poses.

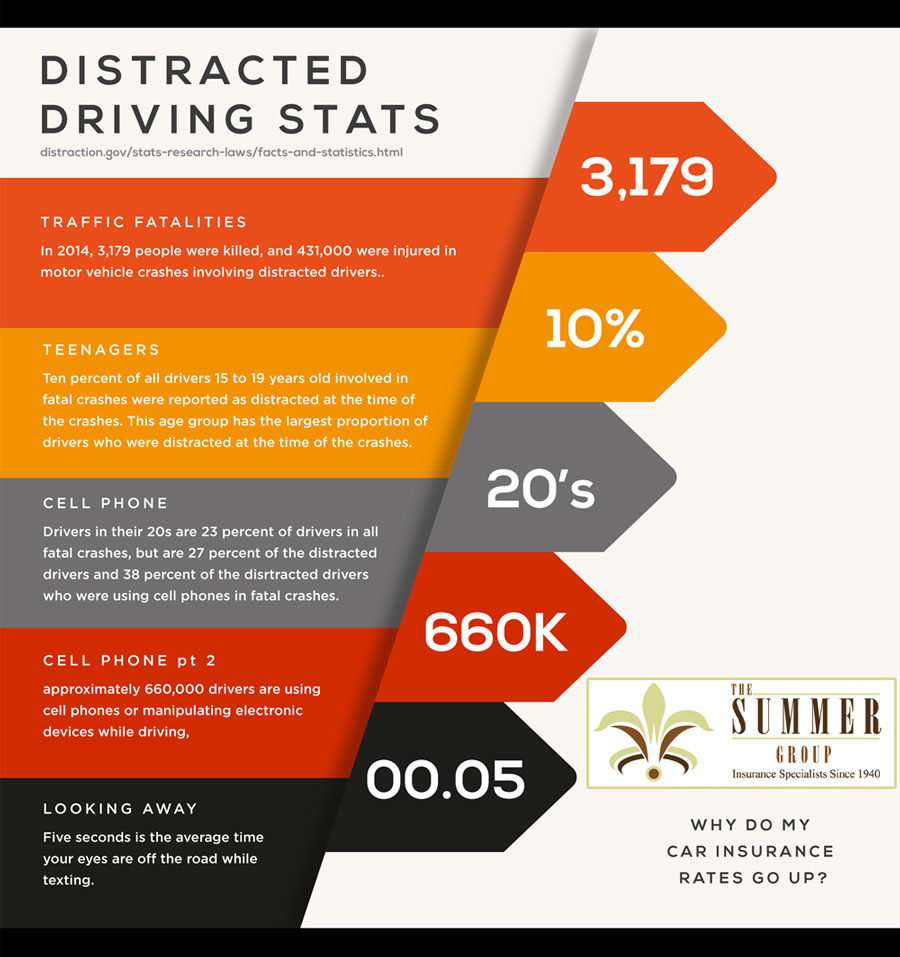

- In 2014, 3,179 people were killed, and 431,000 were injured in motor vehicle crashes involving distracted drivers.

- Ten percent of all drivers 15 to 19 years old involved in fatal crashes were reported as distracted at the time of the crashes. This age group has the largest proportion of drivers who were distracted at the time of the crashes. (NHTSA)

- Drivers in their 20s are 23 percent of drivers in all fatal crashes, but are 27 percent of the distracted drivers and 38 percent of the distracted drivers who were using cell phones in fatal crashes. (NHTSA)

- 660,000 drivers are using cell phones or manipulating electronic devices while driving, a number that has held steady since 2010. (NOPUS)

- A 2015 Erie Insurance distracted driving survey reported that drivers do all sorts of dangerous things behind the wheel including brushing teeth and changing clothes. (ERIE INSURANCE)

- Five seconds is the average time your eyes are off the road while texting. When traveling at 55mph, that’s enough time to cover the length of a football field blindfolded. (2009, VTTI)

The correlation between distracted driving and fatal accidents is one that cannot be ignored, and a major reason why insurance carriers across the state are increasing car insurance rates

Allow us to shop California car insurance rates for you today.

Reason #2

More Expensive Car Repairs

I have never felt so old in my life as I do writing this article. I remember learning to drive well over three decades ago and you were really “cool” when your car had a CD player in it. Just for nostalgia sake, let’s look back at the technology available to 1997 cars versus today’s modern vehicle.

Right off the bat, I am glad that the first mention on the accessories list for this 1997 Toyota Camry above is a “clock”. It does come with an AM/FM radio as well, which will be a nice feature.

Compare that to a 2017 Toyota Camry, with its “wireless charging” abilities, an “App Suite” where you can stream your favorite music and radio channels. Navigational system with live traffic alerts, voice activated features, and engine monitoring LCD screen.

Look, no one is claiming that in 1997, these features weren’t really important. We simply want to point out the stark differences and the exponential growth in automobile technology in a relatively short amount of time.

This means if/when these cars are involved in collision accidents, there is so much more that has to be accounted for, and the cost to fix, replace, or repair them is much higher.

Nowadays, your local body shop doesn’t just have to be well adapt and skilled in fixing a bumper, now they need a computer science degree to figure out all of the moving parts. The cost of labor and materials has skyrocketed as a result.

This can cause insurance companies to increase rates. If their cost to fix a car, or 10’s of thousands of cars goes up, then insurance companies have no choice but to raise the rates of everyone to maintain profitability.

To get a comprehensive insurance proposal…

Reason #3

Marketers Make Funny Stuff

According to 2013 SNL Financial report, GEICO spends about $6 of every $100 it collects in premiums on advertising, totaling $1.2 billion annually. Allstate increased its budget last year by 5.7% to reach $900 million, and State Farm pushed its spending up 5.1% to $800 million.

In general, insurance companies spend so much, they outstrip every other American industry by nearly 8%. Carriers say keeping their name in the minds of American consumers is worth the cost, but critics are beginning to voice disapproval. According to J. Robert Hunter of the Consumer Federation of America, the massive ad budgets of auto insurers are a big part of the reason GEICO and Allstate have had to raise rates this year.

He states “It drives rates up since every penny of the ads is built into the rates.”

While we all laugh at the funny commercials put out by big companies, there is an accountant and a company actuarial off somewhere making the determination that they need more money as a company. Since insurance companies don’t depend on the kindness of strangers for their income, it’s safe to say, they plan on getting it from you, the policyholder.

What does the future hold, and is there hope?

It’s uncertain what the next 20 years looks like. With self-driving cars on the way, who knows how and when insurance rates will drop, or if they ever will.

The beauty of working with an independent insurance agency like The Summer Group, is that when California car insurance rates increase, we can always look at the current insurance marketplace and find the company that offers the best coverage for your situation, and also works within your budget.